Oh, the irony! Just days before the global market went into a tailspin, President Biden declared he had “cured the economy.” You heard that right; the man who promised to deliver us from economic woes now finds his remarks eclipsed by a market free-fall.

Biden’s Bold Claim: A Cure-All President?

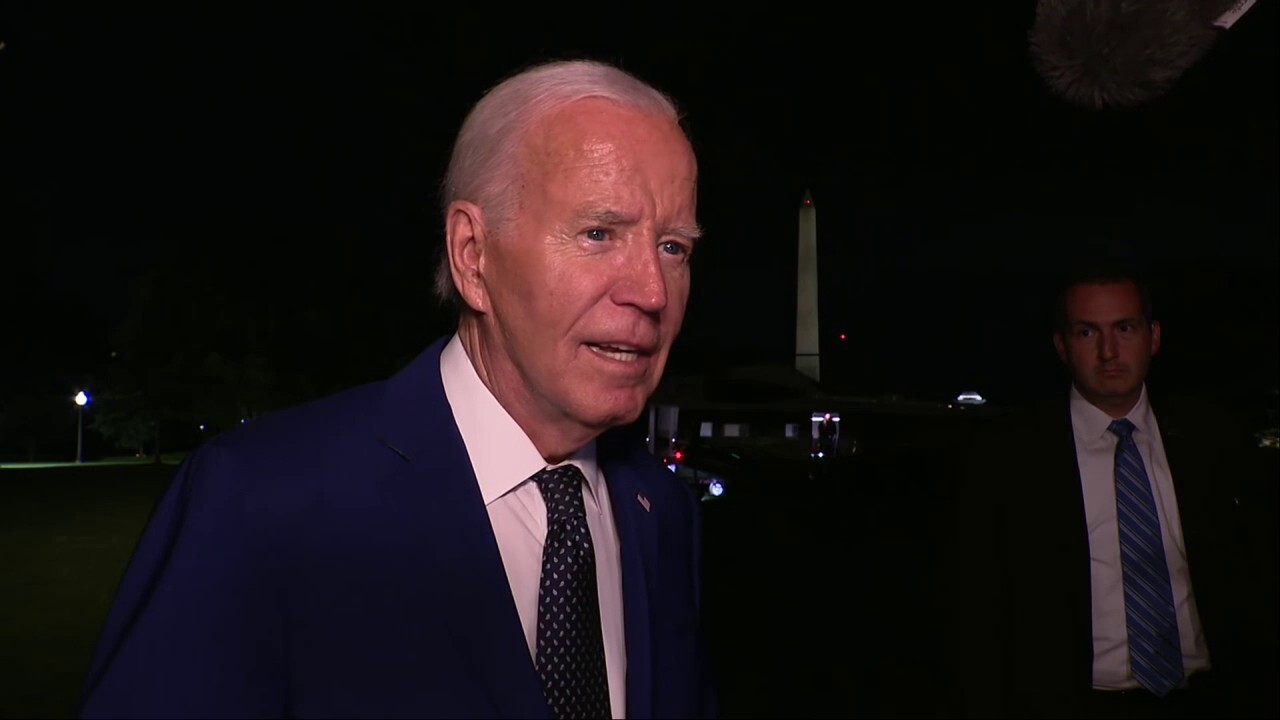

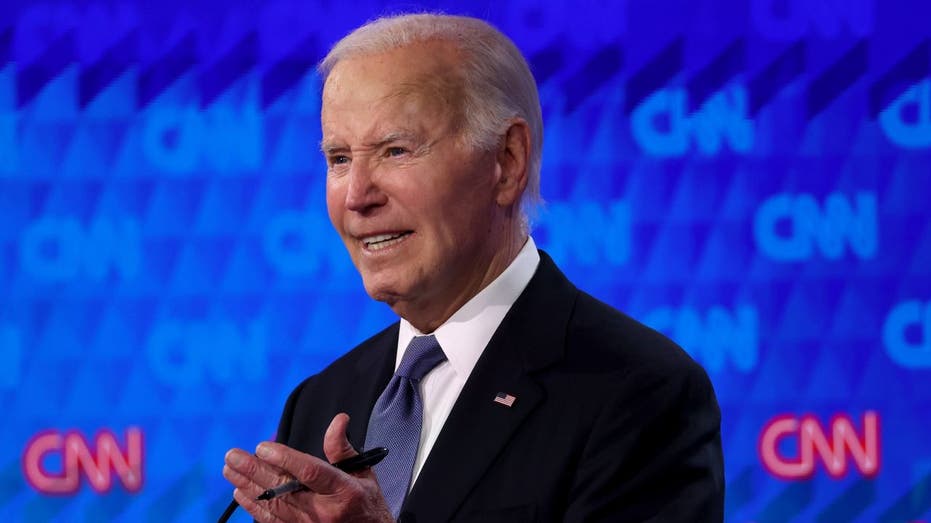

In typical fashion, Biden addressed a throng of reporters and waxed poetic about his presidential legacy. His claim? Not only did he heal the economy, but he also fixed the environment and a bunch of other minor issues. Talk about multitasking!

A reporter asked sharply, “Mr. President, what do you want your legacy for Gen Z to be?” To which Biden retorted, “That I cured the economy. And the environment. And a few other small things.” The confidence was palpable; the markets, however, didn’t get the memo.

Mirror, Mirror on the Wall, How Scary is Wall Street This Fall?

Wall Street’s Fear Gauge at a Four-Year High

The timing of Biden’s declaration couldn’t have been more comically misaligned. By Monday, global stocks were in free fall, and Wall Street’s fear gauge, the Cboe Volatility Index (VIX), was screaming at its highest level in four years. That’s what we call dramatic irony, folks.

For those keeping score, the VIX shot up 172% to 62.27 as the trading day began, approaching levels not seen since the grim early days of the COVID-19 pandemic. Wall Street traders were equally animated, scampering like caffeinated squirrels.

Let’s break it down further. The recent plunge in stock prices ended the VIX’s relatively serene pandemic-era stint where it hovered below 40. As soon as the less-than-stellar July jobs report dropped like a lead balloon, fear levels surged. Apparently, the economy didn’t get “cured” quickly enough for investors’ liking.

The Unemployment Conundrum

The catalyst? The Labor Department’s dry-as-toast report that revealed the economy added a meager 114,000 jobs in July, while the unemployment rate “skyrocketed” to 4.3%—the highest since October 2021.

The ultimate kicker here is the Sahm Rule, an indicator as ominous as it sounds. A rise in the unemployment rate above a certain threshold typically signals a recession might be on the horizon. Well, roll out the red carpet because the Sahm Rule just made an entrance.

Did the Fed Sit on Their Hands Too Long?

The other pressing question is whether the Federal Reserve dawdled too long in the interest rate department. Rates are straddling a 23-year high, and policymakers did no favors by holding them steady last week. It seems that the need for a swift rate cut is becoming clearer by the second, with the odds of a 50-basis point slash in September looking more likely by the minute.

As investors counted their losses, it became apparent that the economy might need more than a presidential pat on the back. It seems like Biden’s proclamation might just go down as another moment where optimism met cold, hard economic reality.

Takeaway: Cured Economy or Glitch in the Matrix?

So, was the economy really “cured,” or did someone just forget to tell Wall Street? While Biden’s optimism deserves a slow clap for enthusiasm, the market’s nosedive begs a slightly different interpretation of events.

To all you market watchers and policy wonks out there, remember: declarations of economic ‘cures’ are best not tested against the unforgiving realm of stock indices and fear gauges. Until next time, keep your fingers crossed and your portfolios diversified.