Imagine this: You’ve been the dutiful daughter, slogging away to take care of your accident-prone, elderly mother who’s been throwing more fits than a toddler at nap time. Meanwhile, your mother decides to leave a whopping $250k inheritance to your brother. Yes, the same brother who probably thinks “caretaking” is synonymous with “late night snack runs.”

Can you feel your blood pressure rising yet?

One middle-aged Reddit user, aptly named Poesbutler, found herself thrown right into this melodramatic soup. Our dear Poes here had been bearing the burden of her mother’s care, while simultaneously juggling her own whirlwind of a life. Let’s be real—multitasking at this level deserves an Olympic medal.

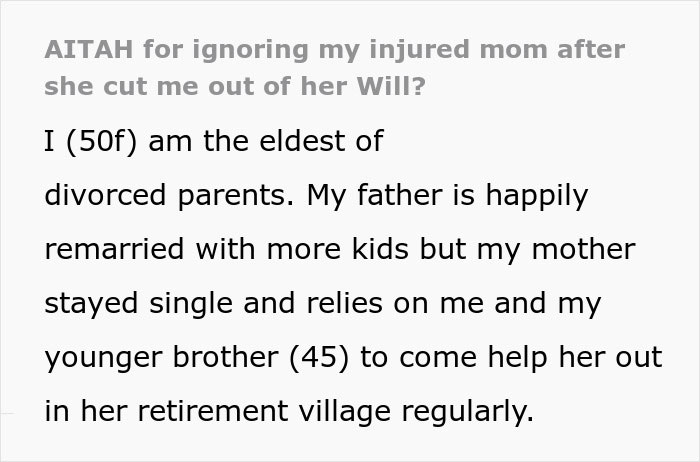

Now, here is where it gets spicy. Despite all the effort and personal sacrifices, Poes discovers that she’s been left with diddly squat from her mother’s will. That’s right—zero, zilch, nada. All of it is gifted to her brother who, for all we know, might still believe that pizza rolls are a well-balanced meal.

To add insult to injury, two-thirds of Americans believe that grown children should care for their elderly parents, suggesting Poes should suck it up and keep on with the caretaking. But seriously, who could blame her for feeling just a tad miffed?

While everyone around her has free advice falling out of their pockets, it’s worth noting that almost half of the sandwich generation—adults who who put their needs on hold to care for their parents and children—are running on empty. According to a Policygenius survey, 66% of them are worried about meeting their family’s financial needs over the next decade. And surprise, surprise, 40% admit they were totally unprepared to become caregivers to begin with.

“We need to figure out where those boundaries lie,” says financial planner Danielle Miura, “and how much we can really handle ourselves as family caregivers.”

But who sets these boundaries when family dynamics are as clear as mud? For Poes, aligning caregiving duties with a negligible inheritance seems like a one-way ticket to Conundrum City.

As Poes’ saga goes viral, she throws more context at our curious heads. And boy, does the plot thicken.

Mix of Support and Criticism

Unsurprisingly, the internet had thoughts. Some rallied behind Poes, waving digital pom-poms and echoing sentiments of “You go girl!” Others? Well, they lobbed virtual rotten tomatoes, suggesting she “suck it up” and continue her unpaid duties.

Speaking of which, let’s plunge into the comments. Roll the clips!

From NTA supporters who believe Poes deserves more than a pat on the back for her sacrifices:

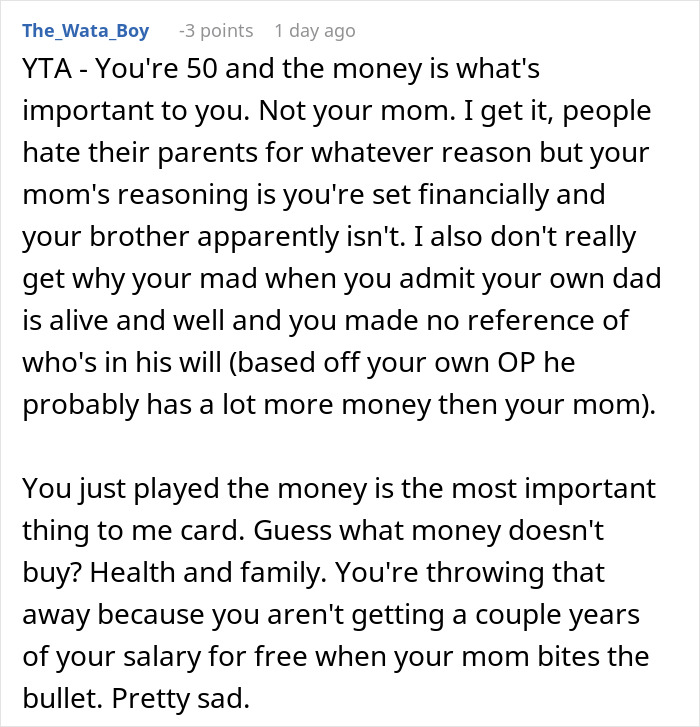

And then, the dissenters chimed in:

Eventually, Poes Issues an Update

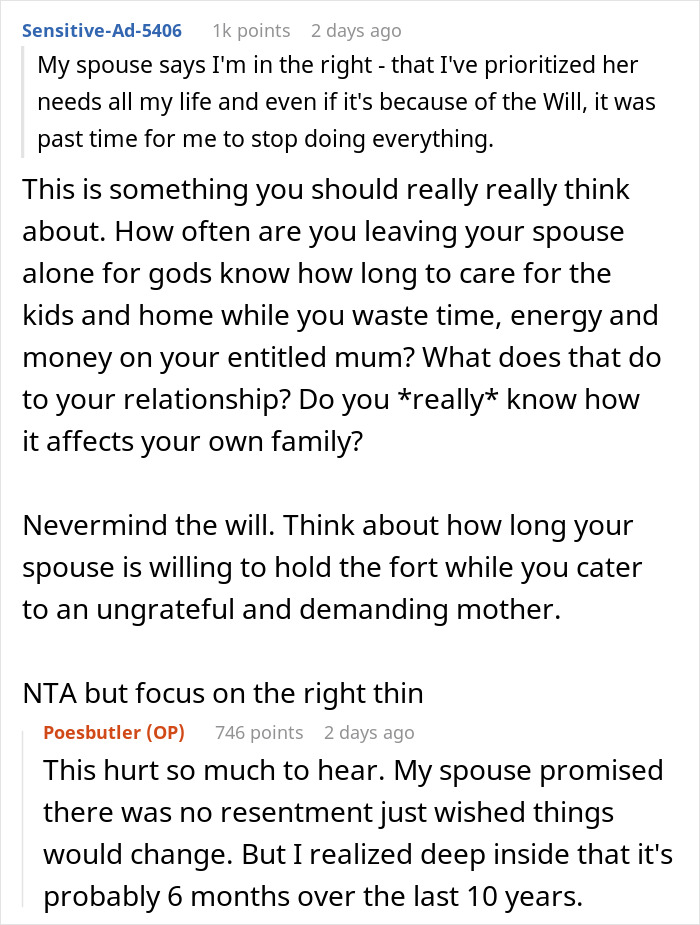

In a twist worthy of a soap opera finale, Poes Butler adjusted her approach. With the encouragement (and some not-so-gentle nudging) from her online confidantes, she decided to draw her boundaries more firmly. This saga of inheritance and familial duty isn’t unique, but it shines a glaring spotlight on the complexities modern families face. You can almost hear Danielle Miura chiming in again with, “See, plan B! I told you!”

For every Poes out there navigating this emotional minefield, there’s a lesson to be learned—sometimes, taking a stand for your well-being steps on a few toes. And perhaps, when push comes to shove, everyone should ensure their own oxygen mask is snug before assisting others.

But here’s my hot take to wrap this up: One strong boundary might just be stronger than a wobbly support system. Oh, and a reliable financial planner can be your life vest when family seas get rough. Cheers to you, Poes. Stand tall—you’ve got this!