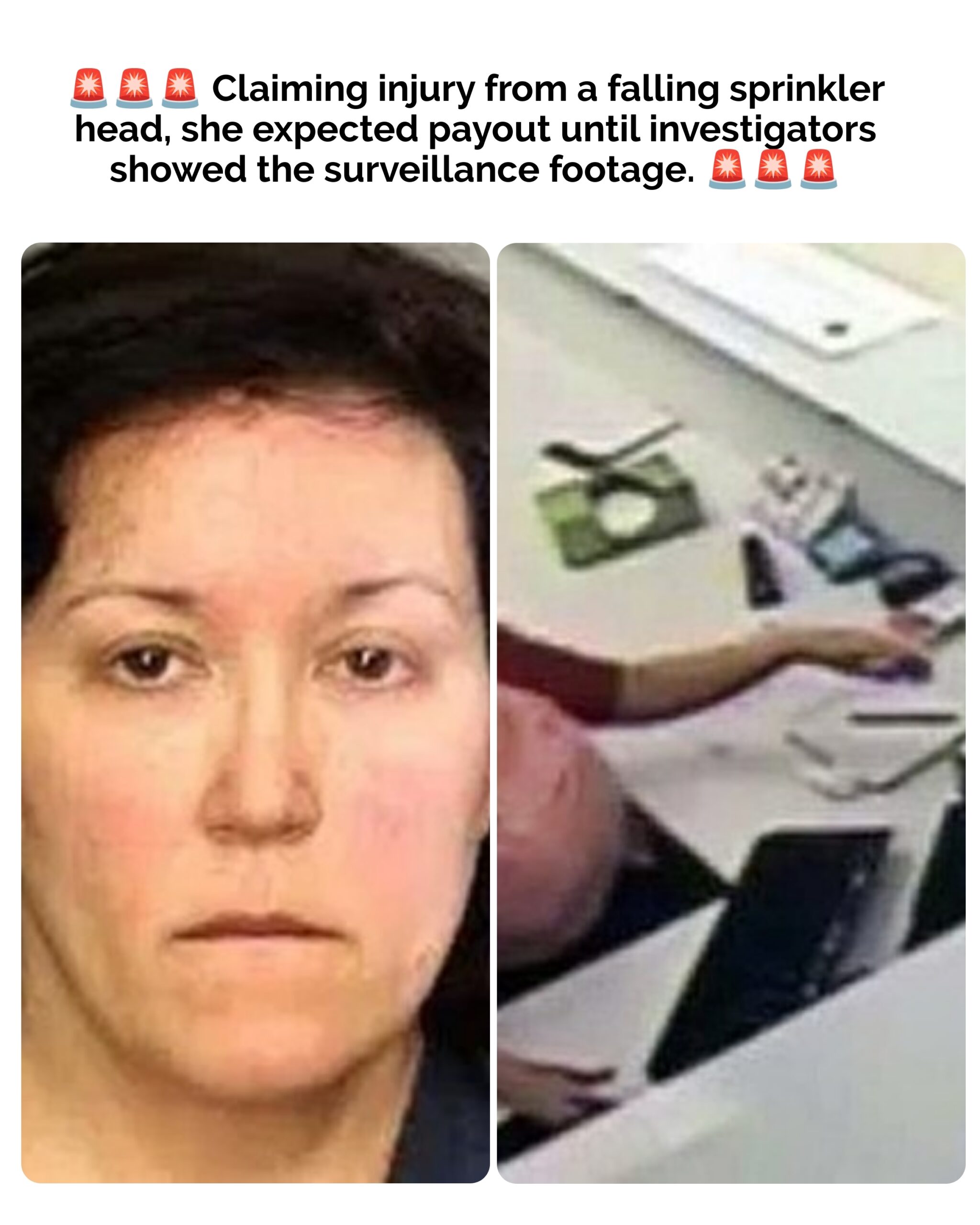

‘Injured’ Florida Woman Demands Big Payout, Video Gets Her Arrested

After a woman was injured by a falling sprinkler head, she insisted that she receive compensation. However, just when she thought she would be getting a nice payday, investigators played the surveillance camera footage.

We all rely on insurance to cover the unexpected. But sometimes, people try to game the system. Take Sheyla Veronica White from Florida, for example.

When a sprinkler head dropped from the ceiling onto her desk, White saw it as an opportunity to make some quick money. Little did she know, she wasn’t the only one observing her actions.

While at her desk job in Fort Lauderdale, Florida, Sheyla White experienced an unexpected moment when a sprinkler head fell near her. Initially, she reacted with shock, checking where it had fallen from. But soon, she saw a chance to benefit. She picked up the sprinkler and intentionally hit herself on the head, causing a visible injury that she claimed happened due to the falling fixture.

White then filed a workers’ compensation claim, hoping for a lucrative settlement. Everything seemed to be going her way until investigators decided to check the security footage.

Instead of the payout she anticipated, White found herself arrested and charged with workers’ compensation fraud, a third-degree felony, as reported by WSVN 7. Ironically, she barely had time to heal from her self-inflicted injury before being taken into custody and photographed for a mugshot by the Broward County Sheriff’s Office.

White received an 18-month probation sentence for her act. Fortunately for her, she wasn’t required to pay restitution as her fraudulent claim was stopped before she could receive any money.

The whole scheme fell apart when her employer’s insurance company became suspicious and contacted Florida’s Division of Investigative and Forensic Services. Detectives reviewed the footage from the security cameras and confirmed that White had staged the injury.

Lieutenant Doreen Rivera shed light on the broader implications of such frauds. While White’s crime might seem victimless, its effects ripple out. Companies are required to have workers’ comp insurance, and fraudulent claims push up the cost of that insurance.

Rivera explained, “Not having it is a felony and not having it is serious. And why is it serious? Because if a worker gets injured on the job and there’s no coverage, they’re going to have to cover their own medical costs which can be overwhelming.” She also noted that the construction industry often sees similar abuses.

It’s not just employees who try to scam insurance companies. Some businesses also engage in fraud by underreporting the number of their employees or paying to use so-called ‘shell companies’ insurance instead of getting their own.

“We see businesses popping up just to get minimal workers’ comp policies,” Rivera said, highlighting a broader trend.

When insurance companies are defrauded, it’s not just them that suffer. The increased costs are passed down to businesses, employees, and eventually consumers. These scams may increase the cost of products and insurance rates for everyone. Unfortunately, the real losers in these situations are the consumers who end up paying the price.

Sheyla White’s case is a stark reminder that attempting to cheat the system is a gamble that can lead to severe consequences. She aimed for a big payout but ended up with a felony on her record, which will serve as a warning to anyone who considers hiring her in the future.